Is PNC Bank In Financial Trouble – Exploring The Financial Health Of PNC Financial Services Group!

PNC Bank is a really important part of the banking world, and how it’s doing affects lots of people, like customers, investors, and the whole financial industry. To figure out if PNC Bank is having money problems, we need to look at a bunch of things like what’s been happening lately, what’s going on in the banking world, what experts say, and how the government is keeping an eye on things.

No, PNC Bank is not in financial trouble. Recent acquisitions, strategic moves, and expert analysis indicate its strong financial position within the banking industry.

In this article, we’re going to dig into all of that to find out if PNC Bank is doing well or not. Let’s get started on figuring out what’s really going on with PNC Bank’s money situation.

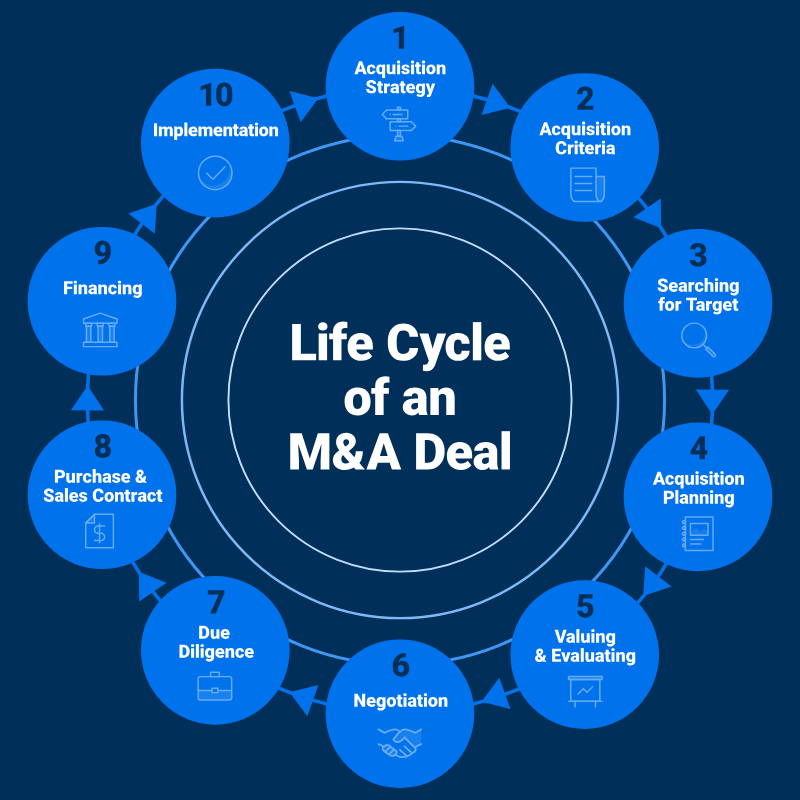

Recent Acquisitions And Strategic Moves – Learn More!

PNC Financial Services Group has stood out in banking by making smart purchases and taking steps to improve its standing in the market and widen its range of services. Let’s take a closer look at some of the important recent buys and plans made by PNC:

1. Acquisition of BBVA USA:

One of the biggest steps PNC has taken recently was when it agreed to buy BBVA USA for $11.6 billion. This happened in 2020 and was a really important move for PNC’s plan to grow. It made PNC one of the top 10 biggest holding companies in the U.S.

The deal also meant PNC got BBVA branches in Texas and parts of the South and Southwest. This helped PNC reach more customers in more places.

2. Portfolio Purchase from Signature Bridge Bank:

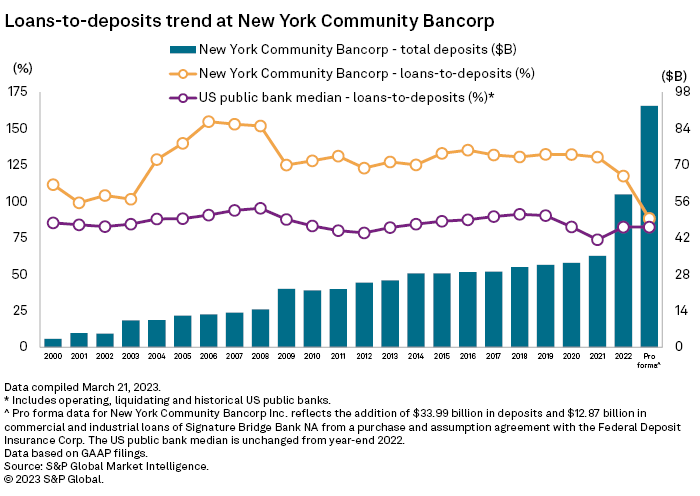

PNC Bank recently made a smart move by buying a bunch of stuff from Signature Bridge Bank through the FDIC. This stuff is worth $16.6 billion, and it includes $9 billion in loans that have already been paid out.

PNC thinks this will help them do better in the fund banking business, especially with helping out private equity firms. This shows that PNC is good at finding chances to grow and making the most of them.

3. Expansion of Fund Banking Business:

PNC has been working hard to grow its fund banking business, which helps private equity firms and other alternative investment funds with financial services.

By acquiring the Signature Bridge Bank portfolio, PNC wants to become even stronger in this area and do an even better job of helping its clients. This expansion fits with PNC’s plan to make money in different ways and find new chances to grow.

4. Strategic Investments in Technology and Innovation:

Besides buying other companies, PNC Bank has been putting money into technology and new ideas to make its online services better and give customers a smoother experience.

They’ve introduced things like mobile banking apps, tools for managing accounts online, and new ways to pay for things. This shows that PNC is serious about keeping up with the latest technology and making sure customers have what they need.

5. Focus on ESG (Environmental, Social, and Governance) Initiatives:

PNC Bank is now paying more attention to ESG initiatives, understanding how crucial it is to be sustainable and responsible in today’s business world. They’ve promised to take care of the environment, make a difference in society, and follow good rules for running their business.

PNC hopes that by doing these things, they can make their stakeholders happy in the long run and help make the world a better place.

Acquisition Of Signature Bridge Bank Portfolio – Stay Informed On Banking Trends!

The purchase of the Signature Bridge Bank portfolio by PNC Financial Services Group is a big step to make PNC Bank stronger and offer more services. Let’s take a closer look at this acquisition.

Background of Signature Bridge Bank:

Signature Bridge Bank encountered difficulties and ended up failing, which led to PNC acquiring it. This happened during a period when many people were withdrawing their money from the bank, causing it to collapse. The failure of Signature Bridge Bank was a big deal in the banking world.

Portfolio Details:

The portfolio acquired by PNC from Signature Bridge Bank through the Federal Deposit Insurance Corp (FDIC) comprises a substantial amount of total commitments, totaling $16.6 billion.

Among these commitments, $9 billion represents funded loans, which are assets extended by the bank to borrowers and are typically accompanied by repayment terms and interest rates.

Strategic Rationale:

PNC’s decision to acquire the Signature Bridge Bank portfolio aligns with its strategic objectives. By accepting this portfolio, PNC aims to strengthen its fund banking business, particularly in serving private equity firms.

Fund banking involves providing financial services to investment funds, including managing liquidity and financing short-term investments.

This move positions PNC to capitalize on opportunities in a dislocated market, following the failures of top players in the venture capital/private equity industry earlier in the year.

Market Impact and Industry Analysis:

The purchase of the Signature Bridge Bank portfolio shows what’s happening more widely in banking: banks are joining forces and buying each other out strategically.

PNC is known for being bold in buying other companies, and because it’s financially strong and well-known, it’s in a good position to take advantage of changes happening in the industry.

Also, the fact that PNC could pay for this purchase with the money it already had shows that it’s financially secure and ready to grow even more.

Financial Implications:

While the exact details of how much money PNC spent on the acquisition were not shared, PNC used money it already had to pay for it. This suggests that PNC saw the acquisition as a smart investment that could make them more money in the future.

Experts think that this move will actually help PNC make more profit, with each share of their stock potentially earning around 10 cents more starting in the fourth quarter. This could mean a big boost in how much money PNC makes in a year for each share of its stock.

Industry Trends And Market Conditions – Stay Informed, Stay Ahead!

The banking industry is subject to various trends and market conditions that can impact the financial health of institutions like PNC Bank. Understanding these trends provides valuable context for assessing PNC’s current situation.

1. Digital Transformation:

In the past few years, more and more people have started using online and mobile banking because it’s easy and convenient.

This has made banks like PNC Bank work harder to make their online services better. They’re adding new features and using new technology to keep up with what customers want and to stay competitive.

2. Regulatory Environment:

The banking industry has lots of rules it has to follow, which can affect how banks operate and make money. When rules change, especially ones about how much money banks need to keep on hand, how they give out loans, and how they protect customers, it can change how banks do things and how much money they make.

PNC Bank, just like other banks, has to deal with these rule changes while making sure they’re following the rules and not taking on too much risk.

3. Economic Factors:

The big picture of the economy really matters for banks like PNC. Things like how much interest rates are, how prices are changing, how many people have jobs, and if the economy is growing or shrinking all affect how much people spend, borrow, and invest.

These things also affect how well PNC does because they impact how many people want loans, how safe those loans are, and how much money PNC makes from investments.

4. Competition and Consolidation:

The banking industry has a lot of competition, with many different banks trying to get more customers. Besides regular banks, there are other types of companies like fintech (financial technology) companies and non-bank financial institutions that are also trying to offer banking services.

Another thing happening in the industry is that bigger banks are buying smaller ones to grow and reach more places.

PNC has been doing this too, like when they bought BBVA USA and the portfolio from Signature Bridge Bank. It shows that banks are getting bigger by buying others and expanding their business.

5. Risk Management and Cybersecurity:

As technology advances and cyber threats become more sophisticated, banks face increased risks related to cybersecurity and data protection.

Maintaining robust risk management practices and investing in cybersecurity measures are essential for safeguarding customer data and preserving trust in the banking system. PNC Bank prioritizes cybersecurity and risk management to mitigate potential threats and ensure the security of its operations and customer information.

6. ESG Considerations:

Environmental, Social, and Governance (ESG) factors are becoming more crucial for banks and investors. People expect banks to show they care about the environment, act ethically in business, and help society.

When banks include ESG ideas in their plans and decisions, it can make them look better, attract investors who care about these things, and lower risks linked to environmental and social problems.

Expert Analysis And Opinions – Explore The Latest Analyses And Opinions!

Financial analysts and industry experts are important for understanding how well companies like PNC Bank are doing financially.

They give helpful views on things like what’s happening in the market, how industries are changing, and how well specific banks are doing. Let’s take a closer look at what these experts are saying about PNC Bank’s financial situation.

Ratings and Assessments:

Rating agencies like Standard & Poor’s, Moody’s, and Fitch Ratings regularly check how good banks are with money, including PNC.

They look at things like how good the bank’s stuff is, how much money it has if it makes money steadily, and how it manages risks. PNC’s ratings, which usually range from really good to not so good, tell us how financially safe and reliable it is.

Industry Analyst Reports:

Industry analysts who focus on banking and finance often study financial institutions like PNC Bank in detail. They look into various aspects such as how well the bank is doing, what opportunities and risks it faces, and what its future might hold.

These analysts write reports that help investors and other interested parties understand what’s going on with the bank. Their reports cover things like how much money the bank is making, how well it’s managing its loans, whether it’s following the rules, and what plans it has for the future. Investors use these reports to make smart choices about where to put their money.

Economic and Market Commentary:

Economists and market commentators give us a bigger picture of how banks like PNC Bank fit into the financial world. They look at things like how the economy is doing overall, decisions made by governments about money, trends in interest rates, and global events that might affect banks.

By looking at these big-picture factors, experts help us understand what’s going well and what challenges banks might face, like PNC Bank, in today’s world.

Investor Presentations and Conference Calls:

PNC Bank often talks to investors through meetings, phone calls, and special events. In these sessions, top leaders share updates about how well the company is doing financially, what goals they’re focusing on, and what they predict for the future.

Analysts and investors can ask questions to understand better how PNC works and what plans they have ahead. It’s a chance for everyone to learn more about PNC’s business and where it’s headed.

Independent Research and Commentary:

Other than well-known financial news sources, smaller research firms and industry magazines also share their thoughts about PNC Bank’s finances. These sources offer different views and explanations that add to what we already know. Their reports, papers, and articles help us get a complete picture of where PNC Bank stands in the banking world.

FAQ’s:

1. Is PNC Bank facing financial trouble?

Based on current information and expert analysis, PNC Bank is not considered to be in financial trouble. The company has maintained a strong financial position, evidenced by its recent acquisitions and strategic moves.

2. How does PNC Bank compare to other banks in the industry?

PNC Bank is a major player in the banking industry, known for its strategic acquisitions and diversified business model. While challenges exist within the industry, PNC’s proactive approach to growth and prudent financial management set it apart from its competitors.

3. What factors contribute to PNC Bank’s financial stability?

PNC Bank’s financial stability is supported by its diversified business operations, strong market presence, and strategic acquisitions. The company’s robust cash reserves and prudent risk management practices also contribute to its overall financial health.

Conclusion:

In conclusion, While some may wonder if PNC Bank is having money problems, the facts show that it’s actually doing well. With smart purchases, careful money handling, and being well-known in the banking world, it’s in a good spot compared to other banks.

As with any financial institution, ongoing monitoring and analysis are essential to assess its financial health accurately.